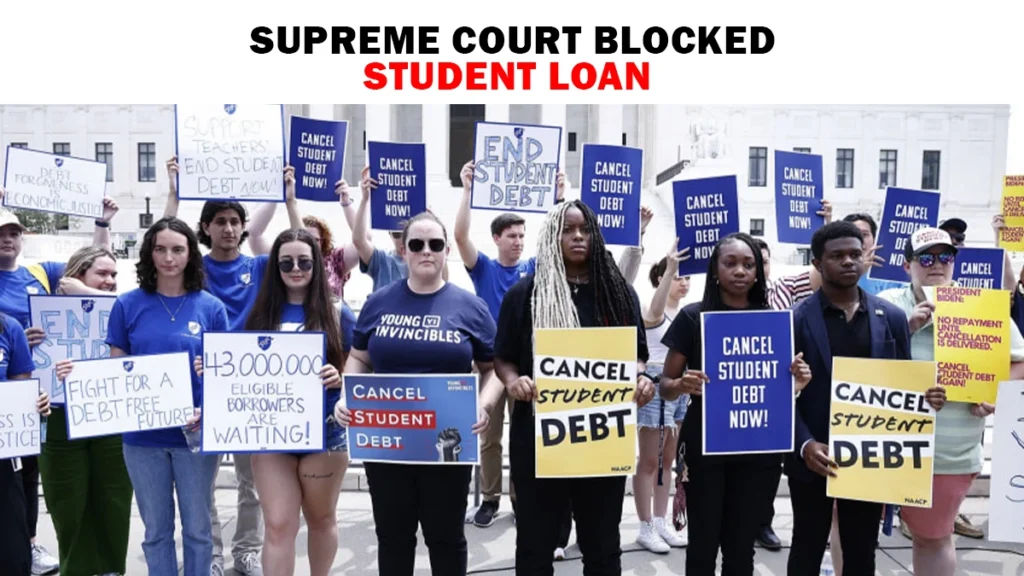

The Supreme Court student loan struck down President Biden’s student loan forgiveness plan on June 30, 2023, ruling that the administration lacked the authority to cancel up to $20,000 in federal student loan debt for eligible borrowers without explicit congressional approval.

The Supreme Court’s decision on student loan forgiveness has sent shockwaves through the higher education landscape, affecting millions of borrowers who were hoping for relief from their student debt burdens.

This ruling marks a significant setback for the Biden administration’s efforts to address the growing student loan crisis in the United States.

As an experienced observer of education policy and student loan issues, I’ve closely followed the developments surrounding this case.

The implications of this decision are far-reaching, impacting not only current borrowers but also shaping the future of higher education financing and accessibility.

Let’s go through this news in detail of this landmark ruling and its consequences for students, graduates, and the broader economy.

Supreme Court Student Loan Forgiveness

The Supreme Court’s decision to block President Biden’s student loan forgiveness plan was based on a 6-3 ruling along ideological lines.

The conservative majority argued that the HEROES Act of 2003, which the administration cited as legal justification for the plan, did not provide the broad authority necessary to forgive student loan debt on such a massive scale.

Chief Justice John Roberts, writing for the majority, stated that the administration’s plan to cancel $430 billion of student loan principal went far beyond the authority granted by Congress.

The Court emphasized that such a significant policy decision with enormous economic and political consequences should be made by Congress, not the executive branch alone.

The Biden administration had contended that the HEROES Act, originally passed in response to the September 11 attacks, allowed the Education Secretary to waive or modify student loan programs during national emergencies.

They argued that the COVID-19 pandemic qualified as such an emergency, justifying the broad debt relief plan.

However, the Court found this interpretation too expansive, effectively limiting the executive branch’s ability to implement sweeping changes to student loan programs without explicit congressional approval.

This decision has significant implications for future attempts to address the student debt crisis through executive action.

Is the government paying for student loans?

In light of the Supreme Court’s decision, it’s crucial to understand that the federal government is not currently paying for or canceling student loans on a broad scale as originally planned.

The struck-down forgiveness plan would have provided up to $10,000 in debt cancellation for borrowers making less than $125,000 a year (or $250,000 for married couples), with an additional $10,000 available for Pell Grant recipients.

While this specific plan has been blocked, it’s important to note that the federal government does offer various programs that can result in loan forgiveness or discharge under certain circumstances. These include:

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance on Direct Loans after 120 qualifying monthly payments while working full-time for qualifying employers.

- Income-Driven Repayment (IDR) Plans: These plans can lead to loan forgiveness after 20 or 25 years of qualifying payments, depending on the specific plan.

- Teacher Loan Forgiveness: Eligible teachers can receive forgiveness of up to $17,500 on certain federal loans after teaching for five complete and consecutive academic years in low-income schools.

- Total and Permanent Disability Discharge: Borrowers who become totally and permanently disabled may qualify for a discharge of their federal student loans.

It’s crucial for borrowers to understand that these programs are still in effect and may provide relief options, even though the broad forgiveness plan was struck down.

Staying informed about these existing programs and any future legislative changes is essential for managing student loan debt effectively.

Student loan forgiveness application

With the Supreme Court’s decision to block the Biden administration’s student loan forgiveness plan, the previously opened application process for broad-based debt relief has been discontinued.

The studentaid.gov website, which had been set up to accept applications for the proposed forgiveness program, is no longer accepting submissions for this specific initiative.

However, this doesn’t mean that all avenues for student loan forgiveness have been closed.

Borrowers should be aware that applications for other existing forgiveness programs remain open and active. Here’s what you need to know about current student loan forgiveness applications:

- Public Service Loan Forgiveness (PSLF): If you work in public service, you can still apply for PSLF. The PSLF Help Tool on the Federal Student Aid website can guide you through the application process and help you determine your eligibility.

- Income-Driven Repayment (IDR) Plans: You can apply for or recertify your income for IDR plans through the studentaid.gov website. These plans can lead to loan forgiveness after a set period of repayment.

- Teacher Loan Forgiveness: Eligible teachers can apply for this program by submitting the Teacher Loan Forgiveness Application to their loan servicer after completing the required five years of teaching service.

- Total and Permanent Disability Discharge: If you believe you qualify for this discharge, you can apply through the disabilitydischarge.com website.

It’s crucial to stay informed about any new developments or changes in student loan policies.

The Department of Education and Federal Student Aid websites are reliable sources for the most up-to-date information on loan forgiveness programs and application processes.

Remember, while the broad forgiveness plan was blocked, other pathways to manage and potentially reduce your student loan debt still exist.

FAQ About Supreme Court student loan

Q: Who voted against student loan forgiveness?

A: The Supreme Court voted 6-3 against President Biden’s student loan forgiveness plan. The six conservative justices – Chief Justice John Roberts and Justices Clarence Thomas, Samuel Alito, Neil Gorsuch, Brett Kavanaugh, and Amy Coney Barrett – formed the majority opinion striking down the plan. The three liberal justices – Sonia Sotomayor, Elena Kagan, and Ketanji Brown Jackson – dissented.

Q: What’s the latest student loan forgiveness update?

A: As of August 2024, the broad student loan forgiveness plan proposed by the Biden administration remains blocked due to the Supreme Court’s ruling in June 2023. However, the administration has been working on alternative approaches to provide relief:

- The Department of Education has implemented changes to Income-Driven Repayment plans, including the new SAVE plan, which can lower monthly payments for many borrowers.

- The administration has continued to approve targeted loan forgiveness for borrowers affected by school closures, disabilities, and public service.

- Efforts are ongoing to explore legal avenues for broader debt relief within the constraints set by the Supreme Court’s decision.

It’s important to stay updated with the Department of Education’s official announcements for the most current information.

Q: Is there still a student loan forgiveness application available?

A: The original broad student loan forgiveness application that was briefly available in late 2022 is no longer active. However, applications for other existing forgiveness programs remain open:

- Public Service Loan Forgiveness (PSLF): Use the PSLF Help Tool on studentaid.gov to apply.

- Teacher Loan Forgiveness: Submit the application to your loan servicer after completing five years of qualifying service.

- Total and Permanent Disability Discharge: Apply through disabilitydischarge.com.

- Borrower Defense to Repayment: If your school misled you, you can apply on the Federal Student Aid website.

- Closed School Discharge: Contact your loan servicer if your school closed while you were enrolled or soon after you withdrew.